UFO

Full Member

- Posts

- 710

- Likes

- 934

We have gone with Ceta (broker), Property Extra (underwriter), Aviva (insurer)

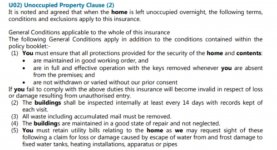

180 days unoccupied, no reduced cover provided water turned off, heating left on and property inspected internally every 14 days.

£281.68

Ceta tel: 01608 647 888. The agent Linesh Nund was very helpful and patient, answered all my questions fully and emailed supporting documents.

LV were £301.78 for 60 days unoccupied

M&S were £302.97 for 90 days unoccupied - very simple process online

Towergate were a waste of time. Online quote was 'under review', no one contacted me. I phoned them, answered all the questions, was told I would be called back which did not happen, I phoned them again and was asked to go through the whole process again as they had no record of my previous telephone conversation. I said if they were interested in the business someone should telephone me, no one has.

180 days unoccupied, no reduced cover provided water turned off, heating left on and property inspected internally every 14 days.

£281.68

Ceta tel: 01608 647 888. The agent Linesh Nund was very helpful and patient, answered all my questions fully and emailed supporting documents.

LV were £301.78 for 60 days unoccupied

M&S were £302.97 for 90 days unoccupied - very simple process online

Towergate were a waste of time. Online quote was 'under review', no one contacted me. I phoned them, answered all the questions, was told I would be called back which did not happen, I phoned them again and was asked to go through the whole process again as they had no record of my previous telephone conversation. I said if they were interested in the business someone should telephone me, no one has.