vindiboy

Full Member

- Posts

- 3,808

- Likes

- 4,268

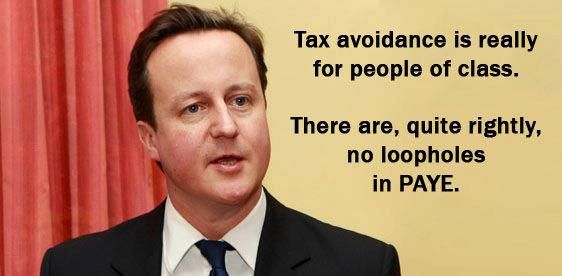

Jimmy Carr has admitted tax avoidance, all legal apparently, good for him, if a legal loophole is there why not use it, Dave [ Cameron ] says he is morally wrong to avoid tax, that sounds good coming from him, If the Dipsticks in the Tax Offices and Government allow these loopholes they should expect them to be used , wish I had found them earlier.:lol-053::lol-053::lol-053: