You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

National insurance contributions

- Thread starter gypo

- Start date

toasty

Free Member

- Posts

- 328

- Likes

- 378

It's worth checking https://www.gov.uk/check-state-pension

In case you were ever `contracted out`, in which case you may opt to carry on paying to increase the state pension.

In case you were ever `contracted out`, in which case you may opt to carry on paying to increase the state pension.

TeamRienza

Full Member

- Posts

- 1,476

- Likes

- 3,756

NO DEFINITELY NOT. The national insurance based state pension scheme changed in 2016 to become the new state pension scheme. You may have the required max number of years to get you the old pension rate of about £129. But if you wish to get near the full current rate (about £179) you will have to contribute to each year from 2016 until the state retirement age or until you have the ‘new’ maximum required number of years.

Search this on google or you will find it has been discussed on here in the past. You need to get registered with the pension service and look at your record of contributions and what you might get. Be aware that most of the forecasts have about 3 estimates and are usually based on an assumption of continuous contributions until state retirement age.

I had to top up my pension contributions by purchasing around 3 extra years (2 years ago) @ approx £880 (I think) for each year. Each year gets you about £4 per week extra. Buying extra years is a no brainier assuming reasonable health and life expectancy. I am about to buy about 6 years for my wife to boost her state pension as she retired early. Also be aware that as far as I can tell there is no longer a ‘widows’ pension. It is all now based on individual contributions.

Davy

Search this on google or you will find it has been discussed on here in the past. You need to get registered with the pension service and look at your record of contributions and what you might get. Be aware that most of the forecasts have about 3 estimates and are usually based on an assumption of continuous contributions until state retirement age.

I had to top up my pension contributions by purchasing around 3 extra years (2 years ago) @ approx £880 (I think) for each year. Each year gets you about £4 per week extra. Buying extra years is a no brainier assuming reasonable health and life expectancy. I am about to buy about 6 years for my wife to boost her state pension as she retired early. Also be aware that as far as I can tell there is no longer a ‘widows’ pension. It is all now based on individual contributions.

Davy

Last edited:

TeamRienza

Full Member

- Posts

- 1,476

- Likes

- 3,756

I just amended the figures to current year. Do check it out carefully as I fear many will be caught out by the changes. If it comes to buying extra years, but you have the full number for the old state pension, then do not buy any years before 2016 /17 as they will not boost your new pension income although the government will quietly accept the money!

Also be aware that if you have small grandchildren that you mind or collect from school (does not have to be every day or full time) etc you can apply for this to be recognised as ‘work’ and apply for credit for the tax years involved as national insurance contributions. I got my brother in law who retired early to do this and it has saved him over £1500 in buying back years. His wife is about to claim for other grandchildren from one of their other families kids. They are in line to save another £3000 plus when it is processed.

Davy

Also be aware that if you have small grandchildren that you mind or collect from school (does not have to be every day or full time) etc you can apply for this to be recognised as ‘work’ and apply for credit for the tax years involved as national insurance contributions. I got my brother in law who retired early to do this and it has saved him over £1500 in buying back years. His wife is about to claim for other grandchildren from one of their other families kids. They are in line to save another £3000 plus when it is processed.

Davy

wildebus

Full Member

- Posts

- 8,992

- Likes

- 14,757

I think the new number is 39 full years, up from the 35 previously.

The cost per year to top up varies, but I don't think it is at the level of £880 a year? Costs me around £200 or so (it may depend what class you are able to top up with I guess).

Just logged onto HMRC and I see:

The cost per year to top up varies, but I don't think it is at the level of £880 a year? Costs me around £200 or so (it may depend what class you are able to top up with I guess).

Just logged onto HMRC and I see:

- 36 years of full contributions

wildebus

Full Member

- Posts

- 8,992

- Likes

- 14,757

depends on income. below a certain income, no.Another question coming from a slight different angle,

Am I legally bound to pay NI contributions up to state retirement age, if I retire now on a small private pension and have already paid NI for 35yrs?

TeamRienza

Full Member

- Posts

- 1,476

- Likes

- 3,756

One of the figures that will be quoted when you get the estimate from the pension service will show what your contributions have gained you to the date of asking, however the best figure will be the one based on your continued contributions to state retirement age. As someone else mentioned, if you were contracted out ( usually government related jobs) the reduced figure will also be shown.

Davy

Davy

harrow

Full Member

- Posts

- 7,610

- Likes

- 10,089

Afternoon all,

Am I right in thinking that if you have 35 years of national insurance contributions in and then gave up work to go full timing in the van living off a small pension you would no longer need to pay NI contributions?

Thanks

Except if your NI had been contracted out at any time. I did 40 years and need another 6 years.

TeamRienza

Full Member

- Posts

- 1,476

- Likes

- 3,756

depends on income. below a certain income, no.

I would assume this will still require you to be working, just not earning sufficient to contribute. If you are not on the system you will presumably not get the credits. At the very least you will need to be claiming universal credit. This is almost impossible to gain if you are often travelling as my brother in law found when he tried to holiday often in the years immediately after his early retirement.

Davy

TeamRienza

Full Member

- Posts

- 1,476

- Likes

- 3,756

wildebus

Full Member

- Posts

- 8,992

- Likes

- 14,757

An associated aside ...

This thread prompted me to just check something I've been meaning to do for ages!

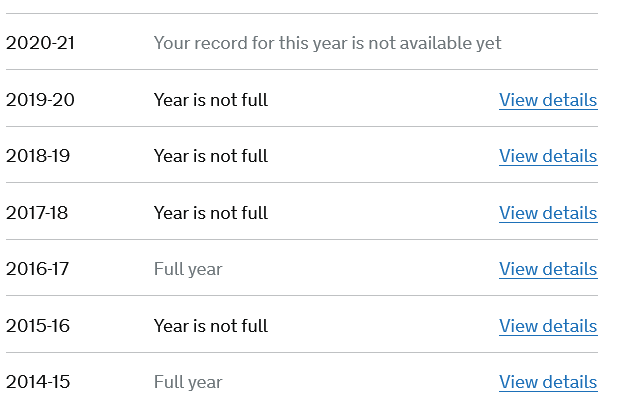

If you check your NI Record you might see something like this:

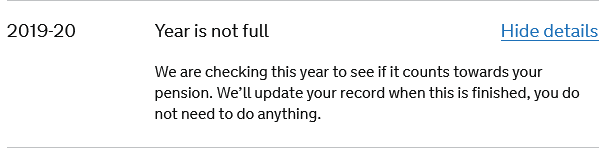

Which looks like you are missing years of contributions? But click on the details and you may see ...

So "Year is not full" may not actually mean that the year is not full, just they haven't done the maths yet.

I just checked my account for 2017-2018 and 2018-2019 and both years I have made the right amount of NI Class contributions as requested so those ARE Full years. A bit misleading if you are trying to work out how many more years you actually need as a minimum.

This thread prompted me to just check something I've been meaning to do for ages!

If you check your NI Record you might see something like this:

Which looks like you are missing years of contributions? But click on the details and you may see ...

So "Year is not full" may not actually mean that the year is not full, just they haven't done the maths yet.

I just checked my account for 2017-2018 and 2018-2019 and both years I have made the right amount of NI Class contributions as requested so those ARE Full years. A bit misleading if you are trying to work out how many more years you actually need as a minimum.

Budgie

Full Member

- Posts

- 140

- Likes

- 208

I am 57 was contracted out for 20 years from age 16 in luckily a good final salary pension scheme, went self employed until 2018, now retired living off savings can take my private pension but going to leave it until later, but still need 4 years NI voluntary contributions @ £14 odd x 52 weeks per year to qualify for the full stakeholder pension of currently £179 week

TeamRienza

Full Member

- Posts

- 1,476

- Likes

- 3,756

Each year at about £880 (it varied in the past) will generate about £4 per week, so £4 x52= £208. You will be ahead of the game in just over 4 years.

Davy

Davy

TeamRienza

Full Member

- Posts

- 1,476

- Likes

- 3,756

THIS ARTICLE COULD SAVE SOME OF YOU THOUSANDS OF POUNDS.

For those of you who have retired early, but do not have a full contributions record, look at this, if you have grandchildren for whom you care for on occasions. You can even look after them at a distance by phone or video call.

www.thisismoney.co.uk

www.thisismoney.co.uk

This is the way of filling back years at no cost to you. As quoted in an earlier post my brother in law used it successfully recently. He is now attempting to get refunds on bought years before I made him aware of this scheme. I will update this post when he gets a reply. We will become grandparents in June but I don’t think a child in Sydney would qualify!

Davy

For those of you who have retired early, but do not have a full contributions record, look at this, if you have grandchildren for whom you care for on occasions. You can even look after them at a distance by phone or video call.

How do I get free grandparent state pension credits?

Does looking after them after school and when they cannot attend nursery or school and during school holidays count?

This is the way of filling back years at no cost to you. As quoted in an earlier post my brother in law used it successfully recently. He is now attempting to get refunds on bought years before I made him aware of this scheme. I will update this post when he gets a reply. We will become grandparents in June but I don’t think a child in Sydney would qualify!

Davy